16 Nov All about the Customer

Developments in the financial services sector have a tendency to spread into the wider world of governance (just look at risk management!) So it makes sense for all boards to pay attention to how the regulators are putting the consumer front and centre.

Across businesses involved in the retail financial services supply chain, boards are rushing to set out their plans to respond to new requirements around Consumer Duty that come into force next year. If you think that sounds a dull regulatory change, think again. It’s upping the ante in a big way. These boards are having to bring much more focus to meeting the new requirements of their businesses: knowing that customer needs are being put first; making products and services fit for purpose; providing fair value; and helping consumers make effective choices.

It’s not just a regulatory matter. In present economic conditions it makes strategic sense for all boards to put the customer more explicitly on – and higher up – the agenda. (And don’t yawn, but it would help with Section 172 as well.) Here are some suggestions on steps to take, and missteps to avoid.

Good practices to consider…

Set out the strategic imperatives of looking after customer interests, alongside the legal responsibilities. That means taking a structured approach to considering all angles: value, reputation, competition, legal and regulatory obligations, customer understanding of what they’re getting… This might seem obvious for management teams (although even they can sometimes slip into thinking that T&Cs are the beginning and end of customer obligations). But even in the most thoughtfully managed companies, it’s rare to see boards spending much time on this from a strategic angle.

Things to avoid…

Assuming that “keeping our customers happy” is simply business as usual and naturally part of our thinking. And so failing to make explicit the strategic imperative. As part of that, it means making sure that the moral and customer care considerations are there alongside the legal obligations preserving and enhancing reputation, must surely be part of a board’s assessment of strategy and strategic risks.

Good practices to consider…

Make “the customer benefit” a touchstone of board discussions. In other words, make sure that the strategic customer angles become an automatic and explicit part of board discussions across the agenda. (Obviously, only where it’s relevant, but that’s likely to be a lot of the time.)

Things to avoid…

Believing that the customer angle is a management responsibility. Of course, many of the detailed aspects are just that: pricing, processes, compliance, communication… But there is a strategic level too which impacts reputation, market share, competitive positioning, culture… And the overall business model could be affected if full consideration is given to fair pricing and the cost of worthwhile consumer support and aftercare.

Good practices to consider…

Think through what’s changing as a result of the developing economic stresses. Of course, different customers are being affected in different ways but the cost of living pressures will be widely felt.

Things to avoid…

Considering that the customer’s “ability to pay” is only a formal obligation for regulated financial services providers. That will be rather an insular approach, especially as the whole “supply chain” in retail financial services is caught under the new rules. And Section 172 requires consideration of customer interests. But, regardless of the formal requirements, how does it fit with your organisational values? Has this been considered by the Board?

Good practices to consider…

Adopt a plan for making sure customers’ interests are factored in and continue to be taken care of. Start by setting out your strategy: for example, is your strategy for customer care to make it as difficult as possible for anyone to actually get attention? (Hopefully not, but that’s what it can often feel like at the receiving end.) And make sure that the strategy and plan are approved after a thorough discussion. It’s what boards are having to do now across retail financial services. And will need to continue to do at regular intervals.

Things to avoid…

Assuming that the way we’ve always treated customers in the past is the right way to treat them in the future. A structured approach to board oversight of this will help the directors to see whether our approach remains the right one as societal expectations and economic conditions change. And putting it into the forward agenda will make it more likely to happen!

Good practices to consider…

Understand how “customer needs” fit into the organisational purpose and values.

Things to avoid…

Relying on process and controls to bring good outcomes. These are necessary but not sufficient. Without the treatment and support of customers being an integral part of the culture, it’s going to be difficult to make it stick. So the Board needs to know how this is going to be achieved, and should keep an eye on how it happens in practice.

Good practices to consider…

Look at the possible benefits of having “the customer” as a specific agenda item from time to time. A deep dive would reinforce a more informal approach in part by making management explicitly accountable for planning and performance across the customer equation.

Things to avoid…

Making all the right noises about “being customer led” or “putting customer needs first” but then letting that be crowded out by more immediate operational issues. Or just working off the assumption that it’s an automatic part of business as usual or a natural part of the culture, when it might not be.

Good practices to consider…

Require the customer angle to be given specific prominence across board papers.

Things to avoid…

Assuming that proposals have weighed up the customer angle. Or, if it’s not there, assuming that it’s because it’s not material. If you expect to see explanation and confirmation in the board paper, it will increase accountability by encouraging the paper owner to check what’s been done.

Good practices to consider…

Know how assurance activity is covering consumer-focused processes, controls and culture.

Things to avoid…

Supposing that past approaches to audit plans and resources remain adequate. It’s possible that the audit universe will need to expand to accommodate the risks of non-delivery of the customer-focused plans and processes, and it might take new expertise and resources.

Good practices to consider…

Think about appointing a NED as “customer champion”. This is quickly becoming a feature of financial services boards because they can see how useful it will be. And it’s an interesting and worthwhile role for a NED.

Things to avoid…

Declaring that this is a whole-board responsibility and therefore shouldn’t be given to a single director. Having a champion doesn’t absolve the board of responsibility. It just makes it more likely that it will give customers proper time and attention.

Good practices to consider…

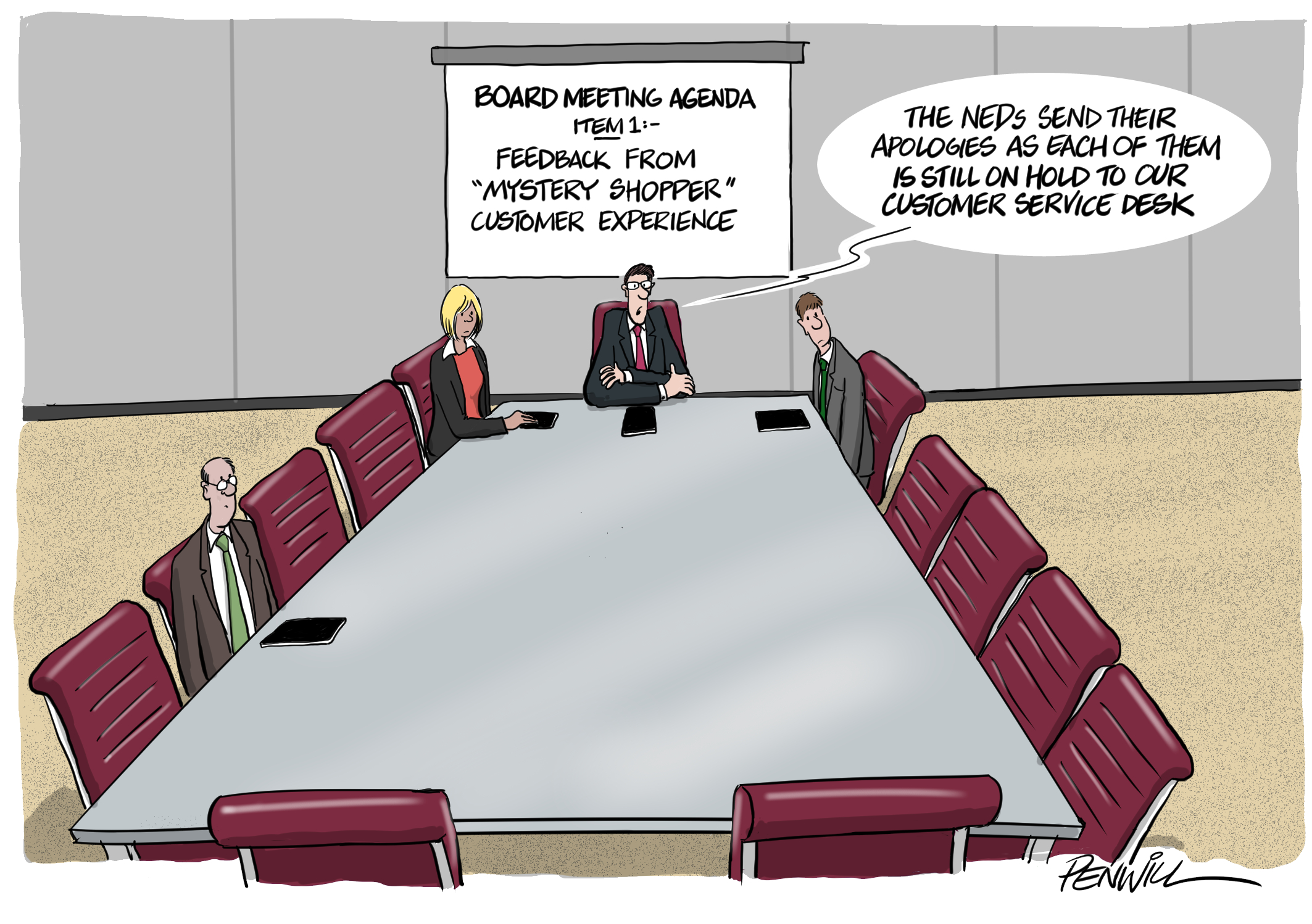

Use your NEDs as mystery shoppers so they can experience how customers feel. (OK, this might be difficult if your business is selling nuclear reactors… but perhaps there are other ways of achieving the same end?)

Things to avoid…

Giving NEDs VIP status in their dealings with the organisation, so they are insulated from real customer experience.

Download This Post

To download a PDF of this post, please enter your email address into the form below and we will send it to you straight away.